Project 2025's Success Rate So Far Will Terrify You – Yahoo

Donald Trump denied ties to Project 2025 last year, yet under his second term, it’s 47% complete, impacting several federal agencies.

The Trump administration has signaled plans to shut down the U.S. Department of Education. This mimics the plans outlined in section 3 chapter 11 of Project 2025:

“Federal education policy should be limited and, ultimately, the federal Department of Education should be eliminated” (p. 319).

Trump plans to cut programs and staff via executive orders and call on Congress to close the department entirely—despite 87.3% of Americans benefiting from the program.

The Trump administration is reportedly drafting an executive order which would eliminate the DOE.

The proposed cuts to the Department of Education would have significant and far-reaching effects on Americans, particularly students and families. These cuts would impact various aspects of education, from K-12 to higher education, and disproportionately affect low-income communities.

School districts are already bracing for potential federal funding cuts, which could lead to larger class sizes for your kids, fewer resources, and reduced support for vulnerable students.

Section 3 Chapter 18 of Project 2025 proposes significant changes to labor laws and worker rights that would substantially weaken unions and worker protections.

The Occupational Health and Safety Administration (OSHA) is undergoing significant changes under the Trump administration. These changes have involved a focus on deregulation and reduced enforcement.

The Trump administration is significantly impacting workers unions and labor relations. Key changes include:

Since Donald Trump returned to the White House in January 2025, several major tax changes have been proposed or implemented. Here’s what they mean for you and your wallet:

1. State and Local Tax (SALT) Deduction Cap

What’s Changing? Trump has proposed eliminating the $10,000 cap on state and local tax (SALT) deductions, which was put in place under the 2017 Tax Cuts and Jobs Act (TCJA).

Who Benefits? Wealthier Americans would see significant tax cuts.

What’s the Impact? This would increase the federal deficit, potentially leading to cuts in public services or future tax hikes.

Section 4 Chapter 26 of Project 2025 discusses the use of tariffs in its economic reform proposals.

What’s Changing? Trump has proposed tariffs of up to 60% on imported goods.

How It Affects You: Higher import taxes mean higher prices on everyday goods, including:

According to the Peterson Institute for International Economics, these tariffs could cost the average American household over $2,600 per year. Middle and lower-income families will feel this impact the most, as rising costs may outstrip any tax savings they receive.

What’s Changing? Trump and Republicans are pushing to slash corporate tax rates from 21% to as low as 15%. Their plan also simplifies the tax code by eliminating many deductions and credits for businesses.

Who Benefits? Large corporations and billionaires, as they pay less in taxes.

What’s the Impact? The lost tax revenue—estimated to increase the federal deficit by $4 trillion—could result in major cuts to programs like:

If these tax breaks pass, the total cost could exceed $5 trillion over ten years, shifting money away from middle and lower-income Americans to benefit corporations and the ultra-wealthy.

Project 2025 calls for the following tax policy changes:

1. A consumption tax on all goods: Project 2025 calls for a consumption tax on all purchases. (page 698)

2. Income tax hikes: For taxpayers in the 10% or 12% tax rate brackets now, Project 2025 would raise the federal income tax rate to 15%. For taxpayers in the 22% and 24% tax rate brackets, Project 2025 would raise the federal income tax rate to 30%. (page 696)

Economists estimate that a middle-class family with two children and an annual income of $100,000 would pay $2,600 in additional federal income tax if they faced a 15% flat tax on their income due to the loss of the 10% and 12% tax brackets. By comparison, a married couple with two children and earnings of $5 million a year would enjoy a $325,000 tax cut.

3. Home mortgage taxes and interest rates will go up too: Project 2025 calls for eliminating the State And Local Tax deduction (SALT) and privatizing the government’s mortgage lending vehicles, Fannie Mae and Freddie Mac, estimated to cost the average homeowner around $1200 per year as mortgage rates go up. (pages 697, 706)

Want more details on these bad tax plans? LEARN MORE HERE and HERE

Section 3 Chapter 20 of Project 2025 suggests significant changes to the Department of Veterans Affairs (VA) and veterans’ benefits.

Recent executive orders have significantly impacted veterans, particularly those employed by or receiving care from the Department of Veteran Affairs (VA)

Endorsed by over 100 right-wing groups, Project 2025 is a blue-print for the next conservative administration to gut checks and balances in order to take control of our lives and to take away our rights and freedoms.

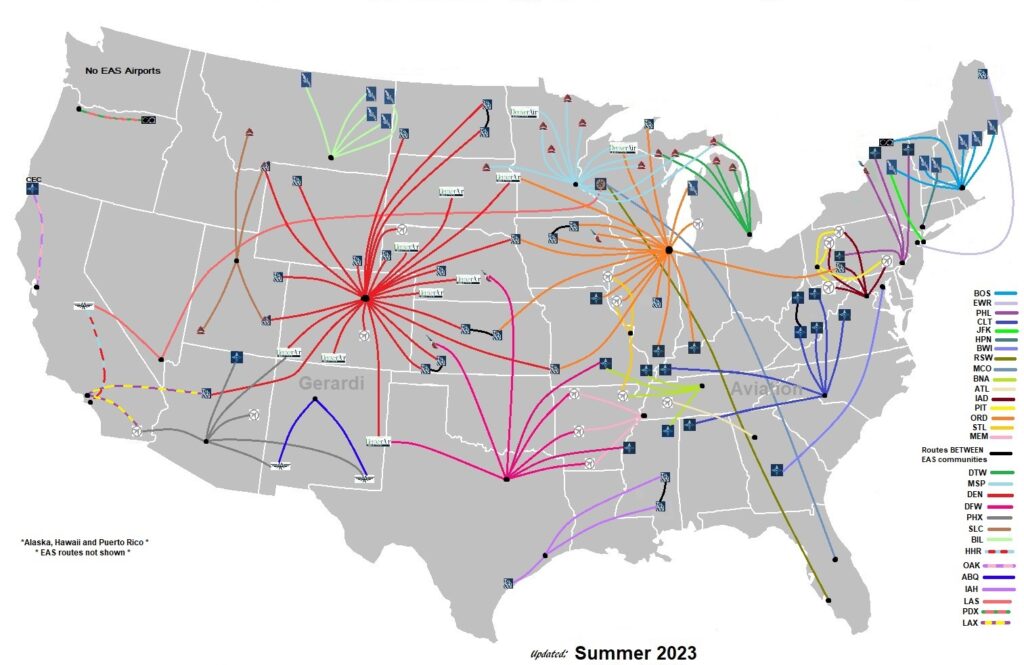

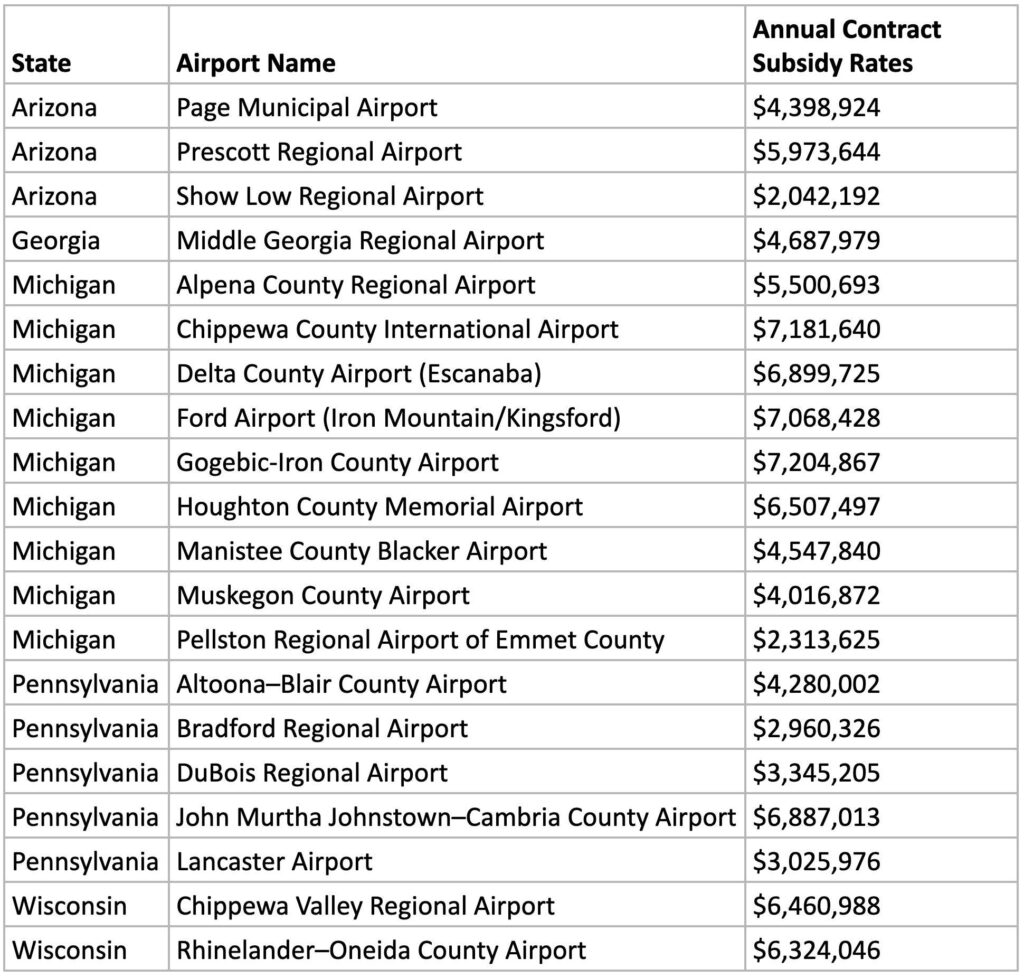

Routes from every EAS Airport in the lower 48 states, as of August 21, 2023. Source

Source – The Heritage Foundation

Experts warn that ending the EAS could lead to the closure of numerous small airports, leaving rural communities isolated and disconnected from the rest of the country. Without these subsidies, a round-trip flight that currently costs $200 could skyrocket, making it difficult for many families to afford necessary travel and limiting economic prosperity for rural regions. EAS services are vital for cites like Page, AZ who would otherwise rely on driving to Las Vegas, which is 4.5 hours away.

Donald Trump denied ties to Project 2025 last year, yet under his second term, it’s 47% complete, impacting several federal agencies.

The FTC dropped racial discrimination claims against North Texas car dealerships, citing a Trump-era directive.

Think tank proposals often fade, yet Project 2025 thrives, reshaping government under Trump’s second term agenda.

A Heritage Foundation official has filed a public records request targeting UNC courses on diversity and LGBTQ+ topics, citing Trump’s executive orders.

The Supreme Court’s right-wing supermajority has facilitated Trump’s agenda, letting him run rampant without explanation.

Paul Dans, a key figure behind Project 2025, is challenging Sen. Lindsey Graham in the SC Republican primary, testing Trump-MAGA loyalty.

In 2022, the Heritage Foundation released Project 2025, a conservative blueprint for reshaping federal policies, now in action under Trump.

President Trump signs an executive order to overhaul U.S. homelessness management, prioritizing treatment over housing.

“This is a quiet, devastating shutdown of a national institution,” wrote Dr. Peggy Carr, as NCES faces collapse.

President Trump appoints Michael Rigas as the new acting GSA chief, marking his third GSA role.

Trump’s admin, supported by GOP and recent Supreme Court rulings, is rapidly expanding a surveillance state, impacting privacy.

The White House named David LaCerte to fill a vacant seat at the Federal Energy Regulatory Commission, pending Senate confirmation.

President Trump’s shift in disaster relief could leave Texas vulnerable amidst increasing climate-driven events.

Last week, Congress narrowly passed the “One Big Beautiful Bill Act,” introducing controversial measures like the first-ever national private school voucher program, despite widespread opposition and significant cuts to vital services.

President Trump faces backlash over his spending bill, deemed unpopular and deficit-increasing by analysts.

Donald Trump denied ties to Project 2025 last year, yet under his second term, it’s 47% complete, impacting several federal agencies.

The FTC dropped racial discrimination claims against North Texas car dealerships, citing a Trump-era directive.

Think tank proposals often fade, yet Project 2025 thrives, reshaping government under Trump’s second term agenda.

A Heritage Foundation official has filed a public records request targeting UNC courses on diversity and LGBTQ+ topics, citing Trump’s executive orders.

The Supreme Court’s right-wing supermajority has facilitated Trump’s agenda, letting him run rampant without explanation.

Paul Dans, a key figure behind Project 2025, is challenging Sen. Lindsey Graham in the SC Republican primary, testing Trump-MAGA loyalty.

In 2022, the Heritage Foundation released Project 2025, a conservative blueprint for reshaping federal policies, now in action under Trump.

President Trump signs an executive order to overhaul U.S. homelessness management, prioritizing treatment over housing.

“This is a quiet, devastating shutdown of a national institution,” wrote Dr. Peggy Carr, as NCES faces collapse.

President Trump appoints Michael Rigas as the new acting GSA chief, marking his third GSA role.

Trump’s admin, supported by GOP and recent Supreme Court rulings, is rapidly expanding a surveillance state, impacting privacy.

The White House named David LaCerte to fill a vacant seat at the Federal Energy Regulatory Commission, pending Senate confirmation.

President Trump’s shift in disaster relief could leave Texas vulnerable amidst increasing climate-driven events.

Last week, Congress narrowly passed the “One Big Beautiful Bill Act,” introducing controversial measures like the first-ever national private school voucher program, despite widespread opposition and significant cuts to vital services.

President Trump faces backlash over his spending bill, deemed unpopular and deficit-increasing by analysts.