National Guard Deployed in Los Angeles—Just Like Project 2025 Planned

The Trump administration has deployed National Guard Troops to LA, mirroring plans laid out in Project 2025.

The Trump administration has deployed National Guard Troops to LA, mirroring plans laid out in Project 2025.

Lindsey Burke joins the U.S. Department of Education as deputy chief of staff for policy, proposing to reduce federal involvement in education.

Behind Trump’s imperial presidency (and elon), there’s Russell Vought

Congressman Steve Cohen (TN-9) raised concerns about Project 2025’s proposal to cut federal transit funding during a subcommittee hearing.

Project 2025 outlines a vision for traditional family values, focusing on heterosexual, married couples as the societal foundation.

Controversy erupts as a journalist joins a Signal chat with officials discussing military plans and links to Trump’s Project 2025 emerge.

Dani Replogle discusses threats to U.S. farm conservation programs, highlighting court battles and Project 2025’s impact.

Project 2025 aims to expand book bans federally, risking censorship of marginalized stories and stifling creativity.

President Trump announced plans to shift federal student loans from the Education Dept. to the Small Business Administration.

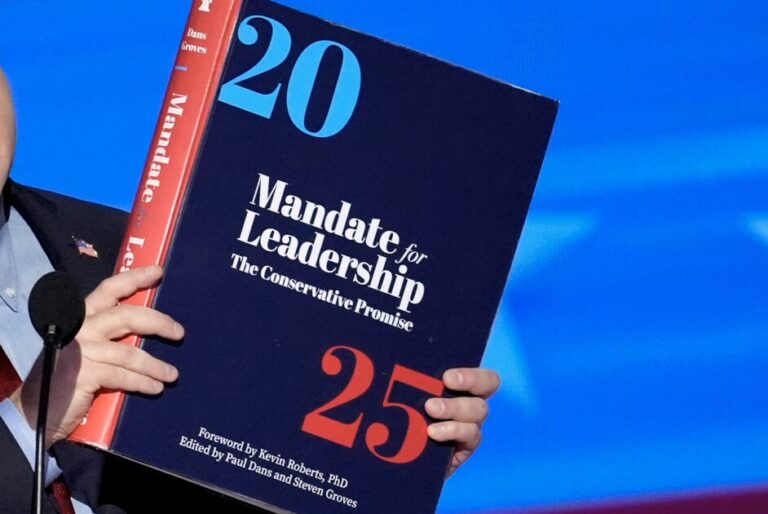

Discover how Project 2025, a plan from The Heritage Foundation, aims to reshape the U.S. government with a focus on trade and tariffs.